What does a Financial Advisor do?

This is a hard question to answer. And if I am saying that, then it must be very confusing for anyone thinking of working with a financial advisor.

To make it a bit more confusing, I actually like the title Financial Planner. However, after doing some research, it seems that Financial Advisor is a more popular name.

But every industry has its quirks when it comes to titles for the same type of job. In Retail, for example, you could be a District Manager, a Sales District Manager, a District Lead, etc. You get the point. Different titles, same job. So it is not just financial services.

To start, I think it might be better to define what a Financial Advisor is NOT (in my opinion).

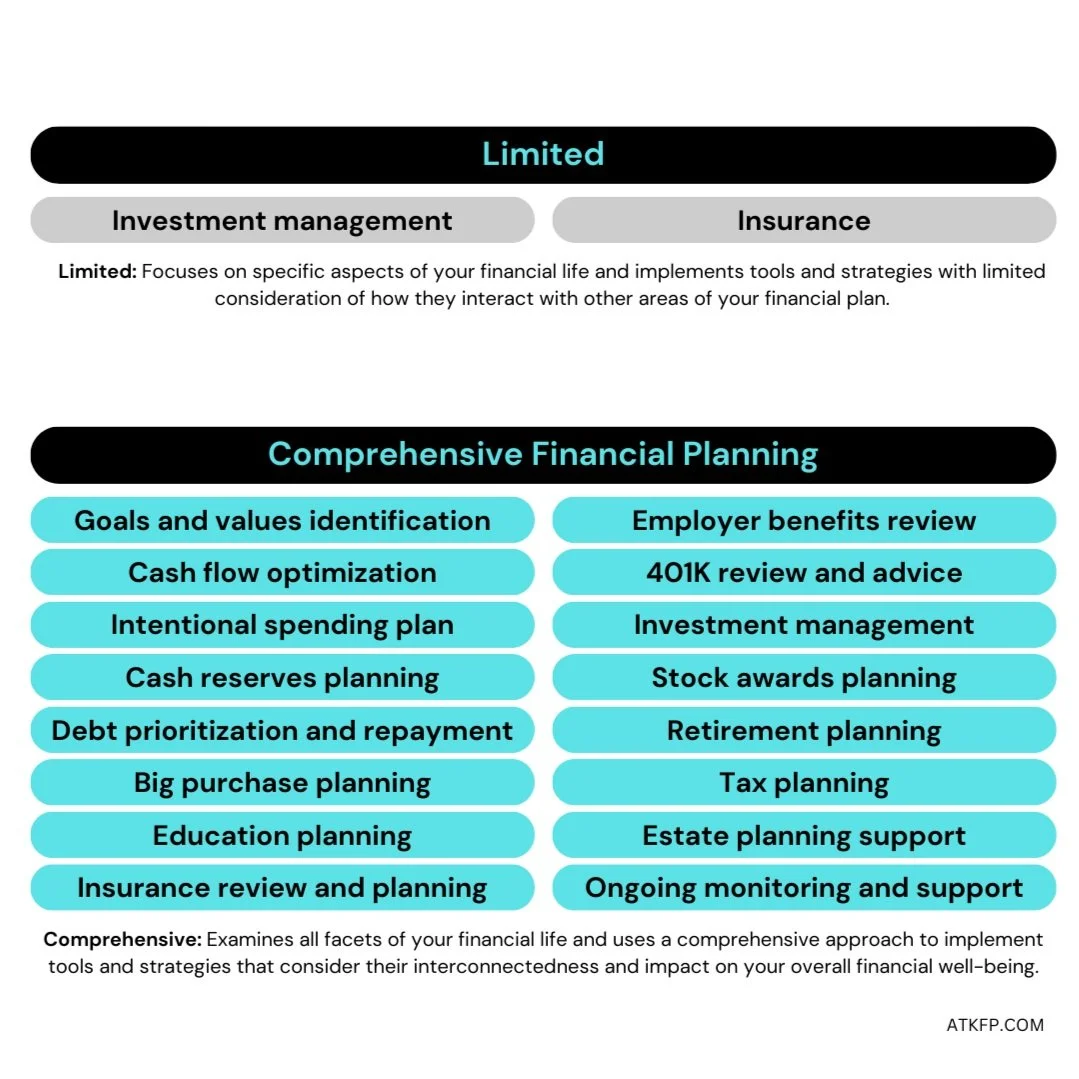

If someone manages investments only, I don't consider them a Financial Advisor. They are an Investment Advisor.

If someone offers only insurance products, I don't consider them a Financial Advisor. They are an Insurance Agent.

Both are critical roles. I for example use insurance agents to help me source insurance products for clients. I personally don't sell products, but I advise clients if a product makes sense for their specific situation. I research and partner with a 3rd party so we can propose and help implement what is appropriate for the client.

And while both of these roles are important, they will not provide comprehensive advice for your full financial situation. They either can't (don't have the needed licenses) or won't because their firm doesn't allow them or it just doesn't fit their business model. Or worse, they don't realize that they only provide limited-scope financial advice. Unfortunately, because the title "Financial Advisor" is not regulated, they may use it.😕

OK, so what does a Financial Advisor do then?

While many may have different definitions, the way I define it is this: If something is related to money, it should be reviewed and appropriate action taken to optimize it.

That could be anything. Even something as simple as a trip to the grocery store is fair game. It is part of an optimized spending plan (more on that in a future blog).

When you are about to make a money decision, that's financial planning. Your action has a consequence. It could be a good, bad or indifferent consequence. But whatever you are about to do will impact something. No pressure!🙂

But let's be real. Nobody walks around and thinks about Financial Planning. And you shouldn't! That's why it is critical to implement systems and processes in place, so when you take action with your money, you know that what is important to you is being taken care of. And that's what a Financial Plan does. It gives you clarity and peace of mind.

A comprehensive Financial Advisor (see picture) will help you make all those financial decisions. Better yet, they will help you put those systems in place to automate as much as possible. To remove as much friction from your day-to-day life, so you can focus on the things that matter, knowing that your finances are moving in the right direction.

Of course, life is not static. It changes and evolves all the time. It can even get bumpy. Your financial plan is not a set-it-and-forget-it exercise. It needs to be flexible so that when things change, the plan adapts.

I am a huge proponent of ongoing Financial Planning. We know that the only constant in life is change. And if that's the case, your plan will need to also change. It is not a static piece of paper (or PDF). Often, as soon as we create a financial snapshot, something in your life changes and we need to tweak it.

The magic is in the Planning, not the plan.

And even after all of the above, it still may not be 100% clear what a Financial Advisor does. Sometimes, you just need to take a leap of faith and experience it. Why do athletes have coaches? Why do we have mentors? It is hard to quantify or truly put down on paper exactly what their role is.

If I were asked what is the biggest value a Financial Advisor can bring you, it would be this:

It is a relationship where you work together by understanding what you want to accomplish and taking appropriate small actionable steps towards those goals. The consistency, habits and accountability to execute on those small goals. It builds and compounds over time.

Financial Planning is a simple concept, but very hard to execute in practice. The delayed gratification, the ongoing puzzles that need to be put together, and the hardest of them all, sticking to a plan when you are thrown a curveball. And life throws a lot of curveballs.