Avoid These 5 Personal Finance Mistakes

Money impacts many aspects of our lives and the decisions you make today have far-reaching consequences for your future. But how do you know how the money decisions you make today impact your future?

While personal finance is deeply individual, being aware of common mistakes can set you on the right path.

1. Ignoring Cash Flow Management:

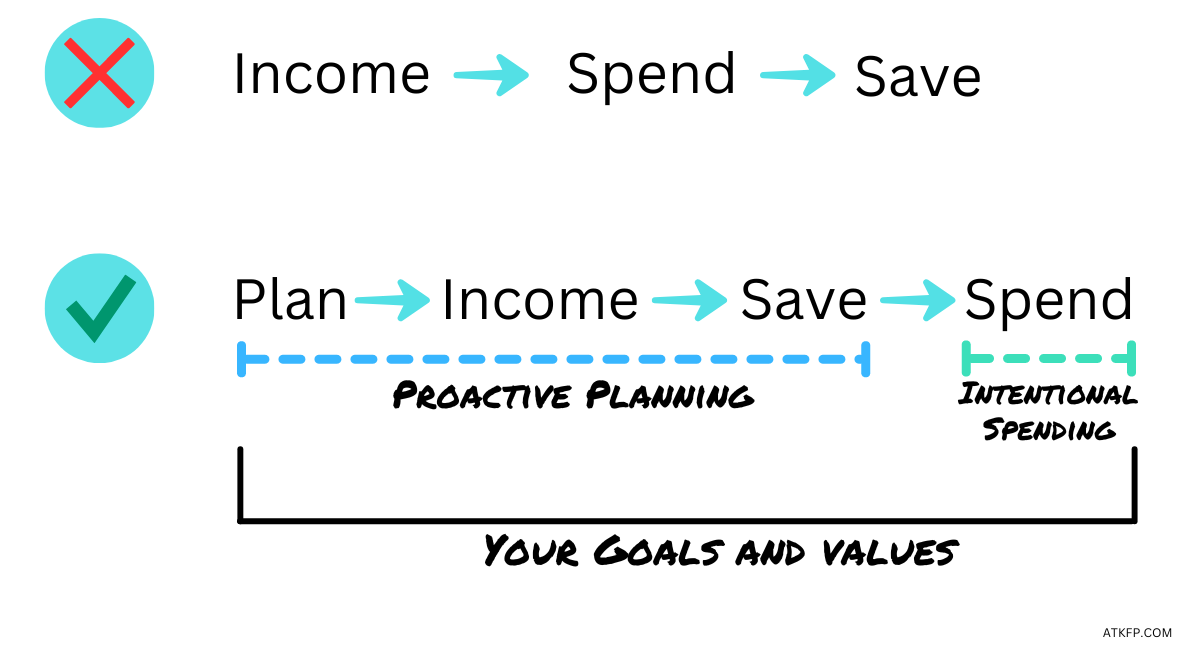

Budgeting alone falls short when it comes to managing your personal income and expenses. What you need is a robust cash flow system tailored to your situation. Restructure the flow of money to prioritize a planning-first approach. Know how your income will be utilized beforehand and give the money direction on where it will go. Give every dollar a job. Take care of yourself first by saving and investing, and then spend what is left. This approach ensures that you've already secured your future, reducing financial stress and keeping you away from unfavorable debt.

From Income > Spend > Save

To Plan > Income > Save > Spend

2. Underestimating the Power of Time:

Time is your most precious asset, and it plays a crucial role in personal finance. Understanding compounding interest is essential. It may take time to see its benefits, but once it takes off, it can be life changing. Starting as early as possible provides the opportunity for your money to grow exponentially, giving you more financial security in the long run.

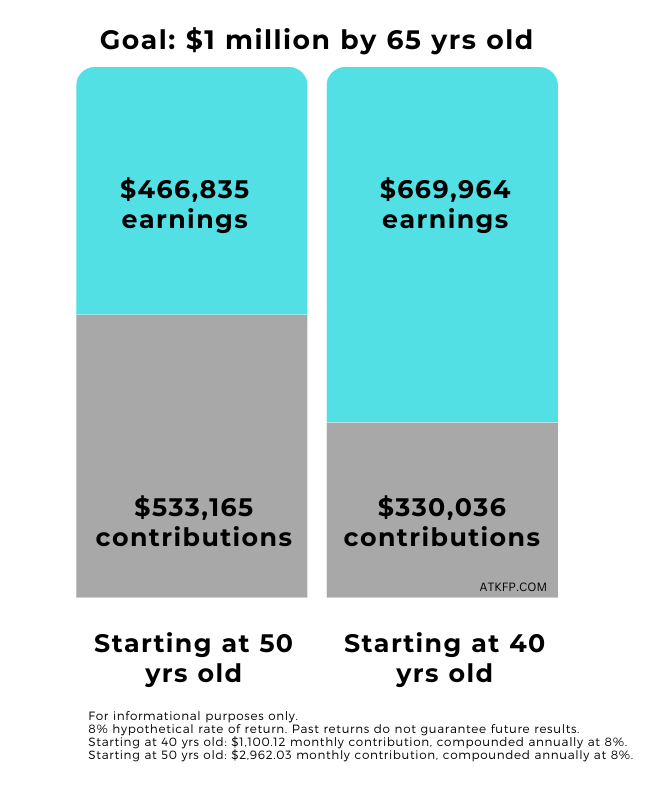

Consider this hypothetical example:

Imagine you need to save $1 Million by the time you are 65, just in time for retirement. Let’s assume that you start with $0 and you earn a hypothetical rate of return of 8% on your investments.

If you start at age 40, to get to $1M, you need to save $1,100.12 a month for a total of $330,036 in contributions. The remaining $669,964 will be from the growth of your investments.

If you start at age 50, to get to $1M, you need to save $2,962.03 a month for a total of $533,165 in contributions. The remaining $466,835 will be from the growth of your investments.

By delaying 10 years, it now needs $200,000+ more of your own contributions to get to $1M. Compounding interest did not have the time needed to kick into high gear.

Time can be your ally or adversary, especially with personal finances.

3. Falling into Lifestyle Inflation Traps:

With career progress often comes higher income, but are you being intentional with that extra money? Avoid absorbing salary increases into your lifestyle without proper planning. Curbing lifestyle inflation doesn't mean sacrificing enjoyment; it means prioritizing spending on things you truly value. You are being intentional with your money. You give it purpose.

Create an intentional spending plan within your cash flow system (item #1 from this list) to align your income with your goals. You work hard for your money. Make sure it works hard for you to support both your current and future goals. Ensure that you truly understand what your goals are and align your financial capital to reflect that.

4. Neglecting Tax Planning:

Taxes are likely the largest lifetime expense you'll encounter. While paying Uncle Sam your fair share is essential, minimizing the amount you "tip" to the government is equally crucial. Your retirement savings and investment strategies can significantly impact your lifetime tax bill.

Traditional and Roth 401(k) accounts, for instance, have varying tax implications. The key is to assess your current and future tax situation regularly to optimize your financial plan and minimize tax burdens.

You are already familiar with Tax Preparation. It is a reactive approach to taxes for which you file your tax return by April 15th to settle any tax liability for the previous year. It looks backward.

In contrast, Tax Planning is an ongoing, proactive approach, with the goal of structuring your finances in a tax-efficient manner. Its goal is for you to pay the least amount of taxes over your lifetime. It provides an opportunity to save and invest using different buckets of money. Each bucket impacts your tax obligation now and in the future. What bucket(s) are appropriate depends entirely on your unique financial situation and goals. There is no one size fits all approach.

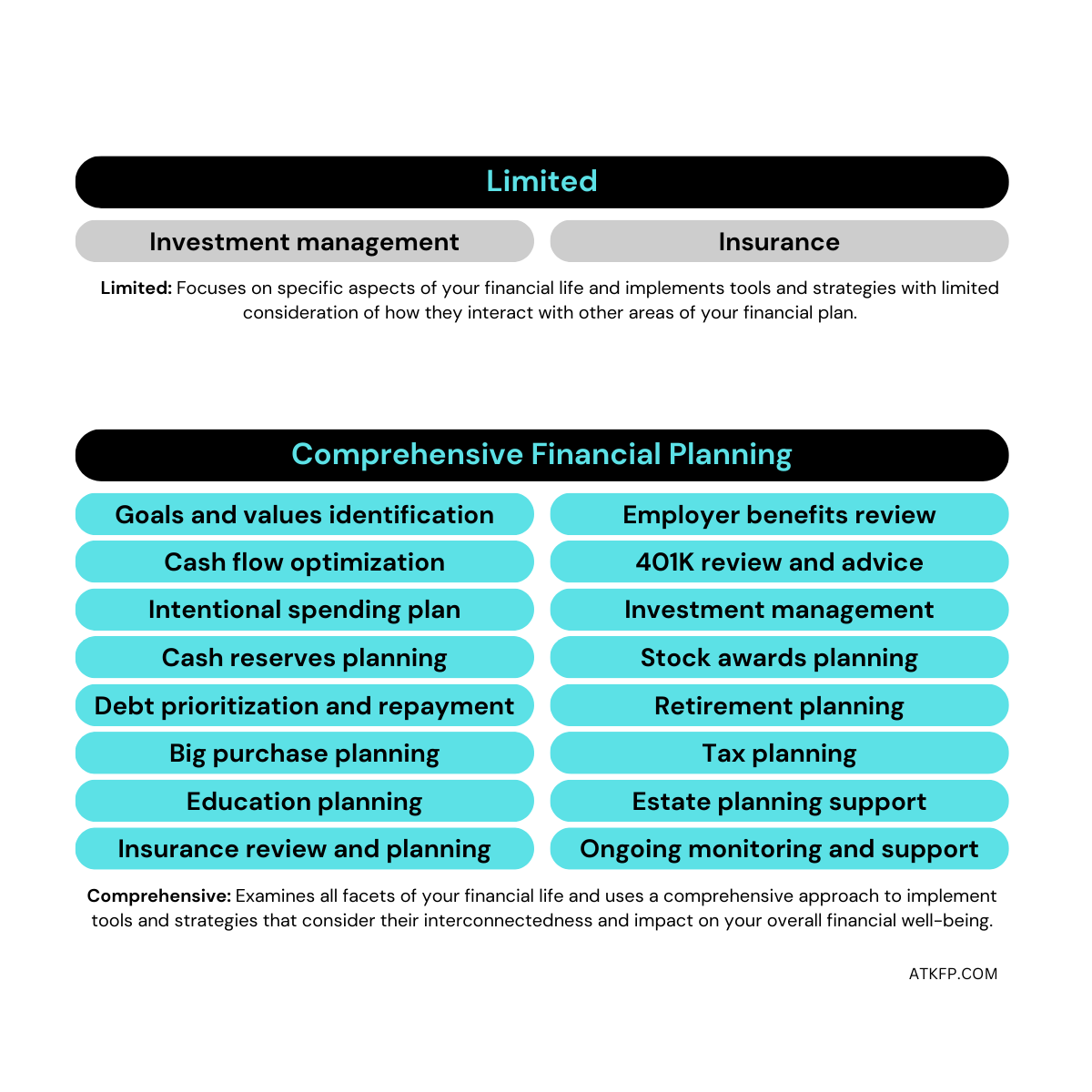

5. Neglecting to have a formal Financial Plan:

Whether you take the charge yourself or partner with a trusted financial advisor, having a formal financial plan is an invaluable long-term investment. A financial plan puts all of your money matters into one place. It provides peace of mind and organization, positively impacting your physical and mental health, as well as your relationships. Just as you rely on information to make smart business decisions, your personal finances deserve the same attention.

Comprehensive financial planning is an ongoing process. Frequently reviewed to ensure the right progress is being made. It remains flexible to capture changes as your life evolves. You are always aware of your financial well-being, and you know what next step you need to take towards your prosperous financial future. It answers the important question, “Am I going to be OK financially?”.

Stay vigilant about these pitfalls, seek and implement personalized financial planning, and gain clarity on your financial path. Remember, your well-being depends on it.

To start your financial planning relationship and avoid these 5 mistakes, schedule a call.