Financial Advisors in Kendall County, IL

Finding a Financial Advisor is not an easy task.

One, it is not always clear what a Financial Advisor does. What exactly is Financial Planning, you may ask. It is tough to define as everyone’s financial situation is different. It is personal finance for a reason. It is highly personal, at least it should be, if you find the right Financial Advisor.

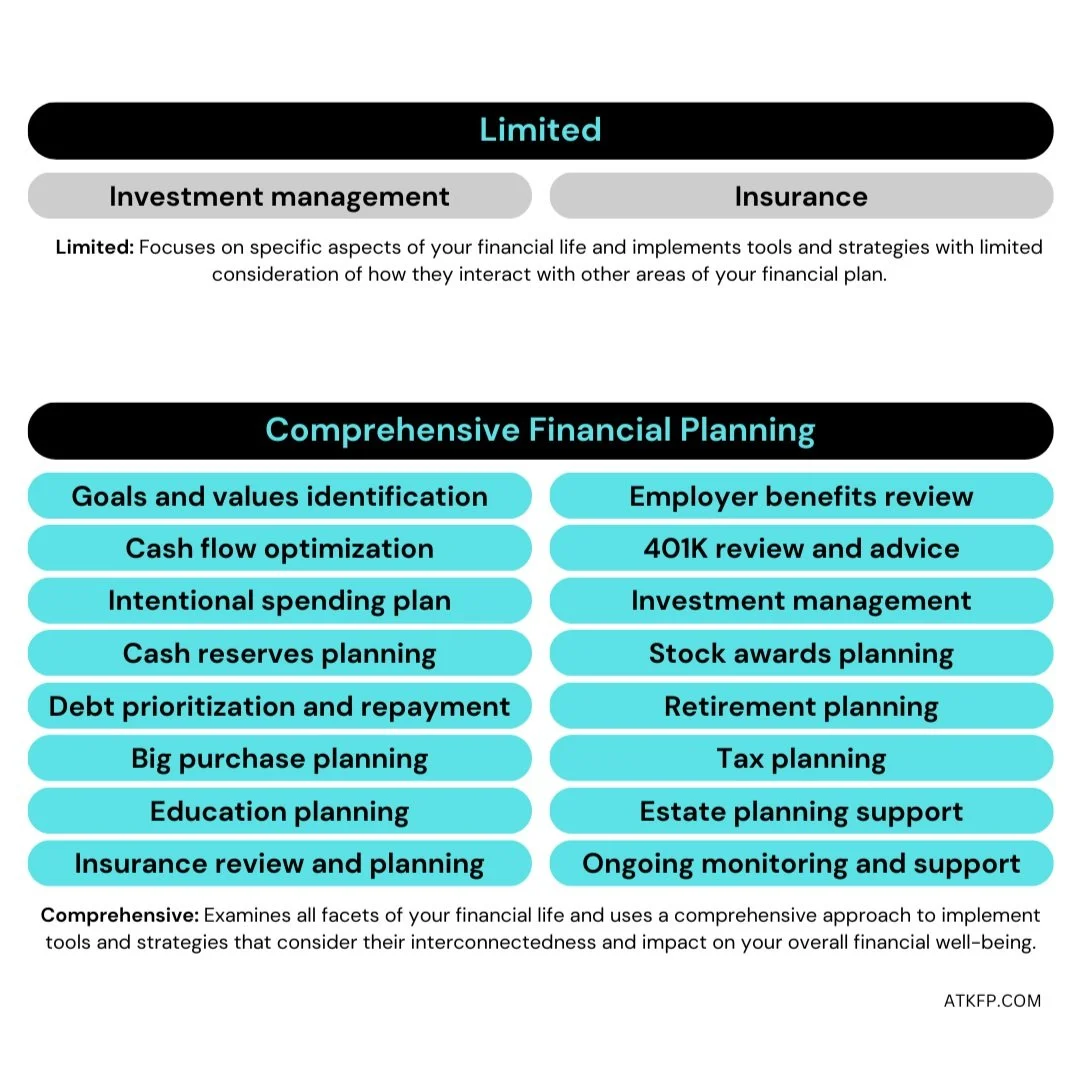

Without going into the details, here is an image that could help explain what financial planning should cover. But I will tell you one thing. It is not just investments and insurance. If that’s all you are getting, you are not getting financial planning and you are most likely being sold products that may not be in your best interest.

So now that you have a better idea of what you should expect from a Financial Advisor, here are a few more items to be aware of.

This should make finding a Financial Advisor in Kendall County, IL easier.

Kendall County includes the cities of Yorkville, Oswego, Plano, Newark, Boulder Hill, Plattville, Lisbon and Millbrook.

Kendall County, Illinois

How does the Financial Advisor get paid?

Here are three main ways Financial Advisors can get compensated:

Commissions

They sell financial products (typically insurance or mutual funds). The commission is baked into the price of the product, so most likely there won’t be a direct out of pocket cost to you.

Commissions are a fine way of compensation, but be aware of conflict of interest. Is the

product sold to you because it is in your best interest, or is it sold to you because the advisor will get a commission out of it? Be aware. There is no such thing as “free” financial advice.Assets Under Management or AUM for short

This is a percentage of your assets that the advisor manages for you. For example, if they manage $700,000 of your investments, and they charge 1% AUM, they collect $7,000 a year. As your investment balance fluctuates, so will the dollar amount of the annual fee collected.

1% x Investment Balance = Fee

Ensure to ask what you get as part of that AUM fee. Just management of investments or comprehensive financial planning? See the image above.

Flat Fee

Financial planning is provided for a flat fee, usually paid monthly, just like a subscription. That may or may not include investment management.

None of the above main fee models is perfect. Each has its PROs and CONs. Some advisors can integrate two or three of the above methods within their process to provide customization for clients. At the end, make sure you are getting value and can see yourself working with the Financial Advisor. If it feels like a transaction, and not a relationship, walk away.

What is their process?

What is their onboarding process?

What systems do they use to help with planning?

How often will you meet?

How do they communicate?

Can you reach out if you have a question?

Are they virtual or can they meet in person?

Questions to ask when interviewing a Financial Advisor:

Are you a Fiduciary 100% of the time?

That means that the advisor only collects money from you and does not get compensated by selling financial products (commissions).

Are you independent or part of a larger organization?

If they are part of a larger organization, is there an incentive to sell products that the larger organization offers? Can they implement outside financial products? Will there be cross-selling involved?

How do you get compensated?

This should be an easy discussion as the advisor should have no problem explaining how they get paid. If there is a runaround, that’s not a good sign.

What services do you provide for the fee?

See the image in the beginning of the blog post describing Comprehensive Financial Planning.

Where will you hold my investments that you will manage for me?

The Advisor should be using a 3rd party reputable custodian. We use Schwab and Altruist.

What is your investment philosophy?

Even though Investments are only part of a comprehensive financial plan, they are an important part. What type of financial instruments does the advisor use? Are they cost-efficient? Do they actively trade stocks? Do they believe in passive vs active investing?

Will you explain the cost of each investment?

Known as an “Expense Ratio”, it is the fee that the investor pays for holding the investment instrument. Some products have higher Expense Ratios than others. You don’t see this fee as a separate item on your bill as it is built into the product. Anything over 0.30%, I would question. A higher Expense Ratio is OK, as long as there is a reason why the investment is being used within your investment portfolio.

What is your experience?

How long have you been in the industry? What are your credentials?

Finding a Financial Advisor in Kendall County, IL (and beyond) can be hard, but it can be a very rewarding experience once you find a Financial Advisor. Financial planning, when done with your best interest in mind can be very powerful. For better or worse, money touches nearly every single thing we do on a daily basis. Creating a custom financial plan is key to reaching your financial goals, both short-term and long-term.

Don’t be afraid to ask hard questions. If you don’t feel comfortable asking any questions, maybe that’s a sign that the advisor is not the right fit for you. Trust your gut.

Please contact the firm if you have any questions, would like to learn more about our services or if you need help finding a financial advisor. I am happy to assist.

ATK Financial Prosperity serves residents in Kendall County, IL (Yorkville, Oswego, Plano, Newark, Boulder Hill, Plattville, Lisbon and Millbrook) as well as nationwide.